What is an Internal and External Analysis?

An internal and external strategic analysis refers to reviewing your organization’s current state from an internal and external perspective. The output of completing an internal and external analysis – also known as a strategic analysis – is to have a clear picture of your organization’s current state.

How does a strategic analysis fit into strategic planning?

Before any organization jumps into the core of strategic planning process, it’s vital to clearly understand where your organization is today. Without clearly defining where you are today (your current state), you can’t define your bold destination of the future (vision) or create the roadmap to get there (your annual strategic plan).

Completing an internal and external analysis lays the groundwork and foundation for the bones of your strategic plan, influencing everything from your competitive advantages, growth strategy, and major themes that influence your entire strategic plan’s framework.It also helps you better understand the gaps you need to overcome to reach your future goals.

Pro Tip:

DO NOT SKIP THIS STEP IN PLANNING! It may seem tempting to skip things like your SWOT, completive analysis, and strategic market analysis, but don’t do it! Build a plan that helps you go from where you are today to a bold place in the future.

What is the output of an internal and external analysis?

The result or output from this work should be a fully fleshed-out current state analysis for your organization’s growth. This should include:

- What you’re best at, and what you need to improve upon.

- Your clearly defined competitive advantages.

- Areas of market opportunity or growth opportunity to pursue.

- A clear understanding of your competitors and what they’re best at.

- Strategic themes to use as the framework for your plan.

Analyzing Your Internal Factors

What is an internal analysis?

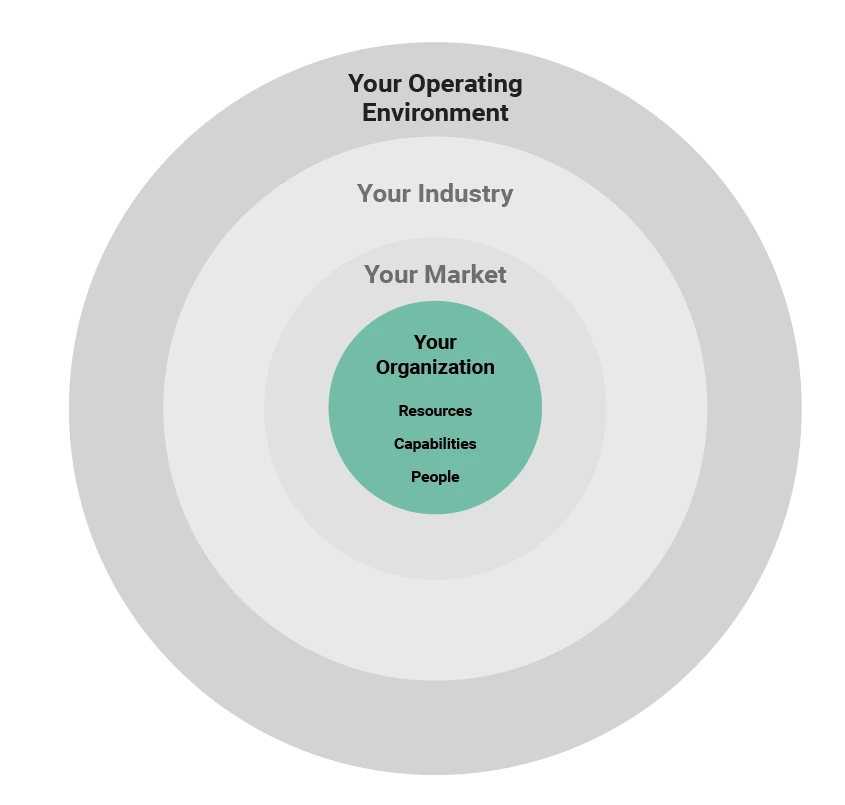

An internal analysis examines your organization’s core competencies today that are influenced by internal factors – factors that are not driven by external market dynamics. This analysis would look at the organization’s strengths and weaknesses in meeting the needs of your customers or stakeholders

As you dive deeper into an internal analysis process, you will examine internal factors that give an organization advantages and disadvantages in meeting the needs of its market, customers, partners, and even employees. Any analysis of company strengths should be market-oriented/customer-focused because strengths are only meaningful when they assist the firm in meeting customer needs.

Internal Factors to Consider

An internal analysis can look at all internal factors affecting a company’s business performance. Here are the three most common factors to consider as you conduct your internal analysis:

Your Organization’s Resources

A good starting point to identify resources is to look at tangible and intangible resources available to your organization.

Tangible resources are the easiest to identify and evaluate financial resources, and physical assets are identified and valued in the firm’s financial statements.

Intangible resources are largely invisible, but over time become more important to the firm than tangible assets because they can be a main source of competitive advantage. Such intangible resources include reputational assets (brands, images, etc.) and technological assets (proprietary technology and know-how).

Your Organization’s Capabilities

Organizational capabilities are used to refer to a firm’s capacity for undertaking a particular productive activity. Our interest is not in capabilities per se but in capabilities relative to other firms. We will use the functional classification approach to identify the firm’s capabilities. A functional classification identifies the organizational capabilities of each of the principal functional areas.

Your Human Resources (Employees)

Technically, this could fall underneath your organization’s resources, but it’s worth separating human resources into its own category. After all, without your organization’s human capital, you wouldn’t exist!

Data to Use in an Internal Analysis

Before you conduct your internal analysis, we recommend collecting the following as references:

Employee Surveys

What do your employees say your organization does well, and where must you improve? Surveys need to be from within the previous 12 months!

Customer Surveys

What do customers love most about your organization, product, or service? How do you best meet their needs? Again, these surveys must be from within at least the previous 12 months.

Business Strategy of Record + Current Performance

Having your previous strategic plan and performance data to reference is always helpful as you complete your strategic internal analysis process.

List of Resources

Your tangible and intangible resources may directly influence your internal strategic strengths, weaknesses, problems, constraints, and uncertainties.

A List of Capabilities

Capabilities [or lack of capabilities] are helpful to reference and identify internal strategic strengths, weaknesses, problems, constraints, and uncertainties.

Questions to Consider for Your Internal Analysis

- What do you do best?

- What do we do best?

- What do our customers value most from our organization?

- What do our customers value most from our organization?

- How do we uniquely serve our customers?

- What are our company resources – assets, intellectual property, and people?

- How are we using our resources well?

- Where do we need to be more efficient?

- How do our employees or shareholders perceive us?

- How are we meeting our employees’ needs?

- What are our organization’s core capabilities?

- What do we need to improve upon?

Tools to Conduct Your Internal Analysis

SWOT Analysis

Conducting a SWOT analysis is easily the most common approach to completing an internal analysis. SWOT stands for strengths, weaknesses, opportunities, and threats. The internal component of a SWOT analysis specifically looks at your organization’s core strengths (S) and weaknesses (W).

Pro Tip:

A SWOT’s S and W portion is directly influenced by your organization’s internal factors – meaning factors you can directly influence. You can check out our full post on SWOT analysis here and download the free SWOT analysis guide here.

VRIO Framework

The VRIO framework is an internal analysis tool designed to help you identify your organization’s competitive advantages.

The VRIO analysis too helps you evaluate if a core strength, capability, or resource is a competitive advantage by assessing if that strength is valuable to your market, rare in competition, hard to copy, and organized to act upon.

Pro Tip:

The VRIO framework evaluates internal strengths but needs external strategic analysis of your competition. So, it uses internal and external factors to help you identify your competitive advantages.

Download our Free VRIO Template and Examples!

What is the Output of an Internal Analysis?

There are a few important outputs from an internal analysis that help create the foundation of your business strategy formulation and direction:

- Output #1: A clear list of internal strengths and internal weaknesses of an organization.

- Output #2: Strategic issues to address (from an internal perspective).

- Output #3: A list of strengths to use as fodder for your competitive advantages (you’ll need to use these paired with a competitive analysis to identify competitive advantages).

- Output #4: Themes to use in your strategic framework and strategic planning objectives.

Analyzing Your External Factors

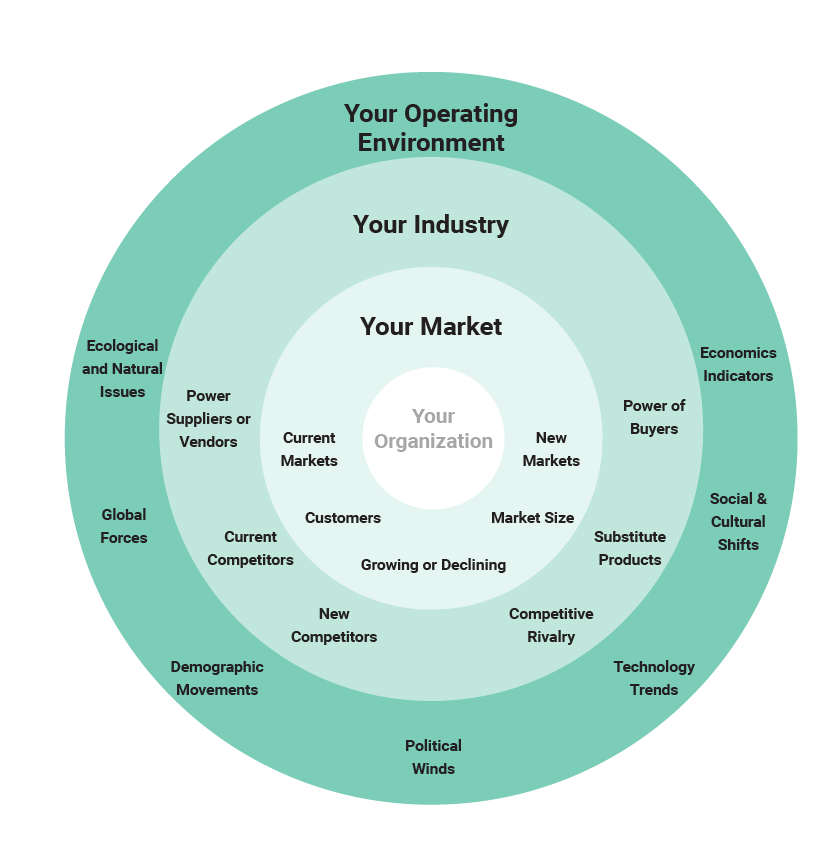

An external analysis examines the external factors and forces that impact your organization’s operating environment. External factors, by nature, exist beyond the walls of your organization and internal environment. They are forces and dynamics beyond your control, but still, impact your organization level and position in the marketplace.

Pro Tip:

A helpful way to think about external forces is to ask, “would this be an issue or opportunity even if our organization did not exist?” If yes, it is an issue that is an external force.

The goal of these exercises is to identify external opportunities, threats, trends, and strategic uncertainties.

External Factors to Consider

An external analysis can be used to look at all external factors affecting a company. Here are the three most common factors to consider as you conduct your external analysis:

Market Trends

Market-level data, including overall size, projected growth, profitability, entry barriers, cost structure, distribution system, trends, and key success factors in your competitive market.

Industry Data and Trends

This data looks at what’s happening in your industry, including factors like vendors, suppliers, competitors, and buyers’ power.

Operating Environment Trends

This looks at global forces, demographic changes, political winds, ecological and natural issues, technological trends, economic factors, and social/cultural shifts. This is most often completed using a PESTLE analysis.

Data to Use in External Analysis

Industry and Market Reports

What are important and potentially important markets? What are their size and growth characteristics? What markets are declining? What are the driving forces behind sales trends? Who competes in your market, and what is their market share?

Market Profitability Projections

For a holistic strategic analysis of your major market, consider the following factors: Is this a business where the average firm will make money? How intense is the competition among existing firms? Evaluate the threats from potential entrants and substitute products. What is the bargaining power of suppliers and customers? How attractive/profitable is the market now and in the future?

Cost Structure

What are the major cost and value-added components for various types of competitors?

Supplier and Distribution Data

What’s happening in your supply chain market? What are the alternative channels of distribution? How are they changing?

Operating Environment Factors

The interest is in environmental analysis and events that have the potential to affect strategy. This analysis should identify such trends and events and estimate their likelihood and impact. When conducting these types of strategic analysis, it is easy to get bogged down in an extensive, broad survey of trends. It is necessary to restrict the analysis to areas relevant enough to impact strategy significantly.

- Economic: What economic trends might have an impact on business activity? (Interest rates, inflation, unemployment levels, energy availability, disposable income, etc)

- Technological: To what extent are existing technologies maturing? What technological developments or trends are affecting or could affect our industry?

- Legal Forces: What changes in regulation are possible? What will their impact be on our industry? What tax or other incentives are being developed that might affect strategy development? Are there political or governmental stability risks?

- Sociocultural: What are the current or emerging lifestyle, fashion, and culture trends? What are their implications? What demographic trends will affect the market size of the industry? (i.e. growth rate, income, population shifts) Do these trends represent an opportunity or a threat?

Questions to Consider for Your External Analysis

Assessing Your Marketing (External Factors):

- What is happening externally and internally that will affect our company?

- Who are our customers?

- What are the strengths and weaknesses of each competitor?

- What are the driving forces behind sales trends?

- What are important and potentially important markets?

- What is happening in the world that might affect our company?

Assess Your Competition (External Factors):

- How are we different from the competition?

- How are our competitors winning?

- How are our competitors losing?

- What does our competition do better than us?

- How do we best serve our market/customers?

- What competitive moves can we make against our competitors?

Tools to Conduct Your External Analysis

PESTLE Analysis

A PESTLE analysis is an external analysis tool that helps you determine how your business or organization stands up against external, macro-level external environment factors that could impact your business. It is an acronym for Political, Economic, Sociological, Technological, and Environmental factors. These are the core areas in the operating environment that could affect the success of an organization the most.

However, it is not enough to just name the external factors that could impact your organization. You must determine whether these factors will primarily pose an opportunity or a threat to your organization’s growth.

Download our Free PESTLE Template and Examples!

SWOT Analysis

As we said earlier, a SWOT analysis is the most common approach to finishing your external analysis. To complete the external analysis portion of the SWOT, you’ll examine Opportunities (O) and Threats (T).

Pro Tip:

A SWOT’s O and T portion is directly influenced by your organization’s external factors – meaning factors you can’t directly influence. You can check out our full post on SWOT analysis here and download the free SWOT analysis guide here.

Competitor Analysis-

Your competitor analysis will look at three different types of competitors:

- Direct competitors (those in your direct market space and always listed with you in a customer shortlist).

- Indirect competitors (those who aren’t quite in your same market sphere, but who you should still watch out for as indirect competitors could become direct).

- Substitutes or new entrants (those who may have alternative products or who are not quite at your level as to be considered direct competition).

Identify Competitors

- Against whom do we compete?

- Who are our most intense competitors? Less intense?

- Makers of substitute products?

- Can these competitors be grouped into strategic groups based on assets, competencies, or strategies?

- Who are potential competitive entrants?

- What are their barriers to entry?

Evaluate Your Competitors

- What are their objectives and strategies?

- What is their cost structure? Do they have a cost advantage or disadvantage?

- What is their image and positioning strategy?

- Which are the most successful/unsuccessful competitors over time? Why?

- What are the strengths and weaknesses of each competitor?

What is the Output of an External Analysis? Why is it Important in Strategic Planning?

Completing an external analysis helps your organization identify opportunities, headwinds, and tailwinds as you build your organization’s core strategy, approach to growth, and moves you can make against your competitors.

Here are the four common outputs from completing an external analysis.

- Output #1: Clear market opportunities to use as part of your growth strategy.

- Output #2: Identify areas of headwinds that will work against your organization.

- Output #3: Your competitive advantages.

- Output #4: Competitive moves you could make against your competition.

Strategic Analysis Process: Pulling Together Your Internal and External Analysis

After you finished analyzing your internal and external environments, it’s important to pull it all together as a final product for your strategic plan.

A complete strategic analysis looks like this:

- Synthesized internal strengths and weaknesses.

- Identified competitive advantages.

- Competitive moves you can make against your competition.

- Headwinds and tailwinds for your market.

- External forces that might impact your organization.

- A clear set of opportunities to use in your growth strategy.

Pulling together a Current State Summary

Once you’ve completed your internal and external analysis, pulling together a current state summary is helpful. This summary captures your current state of the organization and is usually about 3-4 sentences long.

It’s designed to create an objective summary of your organization – where you are today – to include external environment and internal forces impacting your performance.

Quality Check – How You Know You Got it Right

A complete strategic analysis should meet the following requirements:

- Are there clear key components or themes from the SWOT that capture where we are today?

- What are the key shifts we have seen over the past few years (internally or externally) that define our current state?

- What have we learned from the internal and external analysis that is critical to address in the strategic plan?

SWOT – The Most Common Internal and External Analysis Tool

We’ve already mentioned this, but completing a SWOT is the most common exercise to complete both an internal and external analysis. Check out the video, SWOT analysis post, and the free downloadable guide.

An internal analysis looks at the factors that are happening internally in your organization. They evaluate your company’s strengths and weaknesses, taking into account things like resource management and employee performance.

An external analysis would look at the things surrounding your macro- and micro-operating environment such as a competitor analysis and a PESTLE analysis.

You could use one or the other, but it won’t give you the full picture of what your organization is up against or the moves you need to make to ensure you’re shoring up your strengths and fixing your weaknesses. Doing both an internal and external analysis, even in the form of a SWOT matrix, will help you get a full picture of your position in your market. It is highly recommended you do both by utilizing at least one internal analysis tool and one external analysis tool.

Conducting an internal and external analysis is important to conduct and organize before you begin your strategy planning as it allows you to identify and assess your own strengths, weaknesses, and competitive advantages, as well as identify the external factors that may become obstacles in your strategic growth or opportunities for strategic growth.

good fabulous work. keep up.

it is helpful information for me ,i got a clear summary of what i want.

thank you

Hello, your article is very helpful but will you please tell me the reference list of the references you quoted inside so it makes the work easy, thanks

Hi Erica

Thank you very much your your article is very nice and helpful. keep doing to others.x

wow! all the information that i wanted i got. Thank you very much

Thank you very much with this article, because it helps me alot in my studies as i’m currently stduying Business Management…

Hello Erica,,,

Thank you so much for this article.

I have some questions related to this topic; if you can help with

hi we got a deeplly explanation and understood clearly but it was better if it was written in specific explaination keepup it and try for best

Thank you so much . It helps me a lot

thnks alot @Onstrategy

Thanks a lot for the analysis, I really appreciate it and understood a lot of things

thanks and Best Regards

Mustapha

very insightful. nice article it helped me a lot.

the article is very helpful. Tanx Erica

Thank you very much, it helped a lot.

A well researched article which can be used anywhere in business

Well articulated with clear and coherent flow of tasks .Tenable to practical use