How do you prioritize opportunities?

In a sea of opportunities, how do you create focus? How do you know you’ve chosen the right areas to pursue growth?

An important component of any great agile strategic plan is clearly identifying and prioritizing where you’ll grow. While you work through the planning process, you’ll probably face this task as you complete your SWOT analysis and move into developing your strategic priorities or objectives.

👍 Tip

If you haven’t completed your SWOT analysis, jump into our free guide here so you can complete one.

First, know that you’re not alone! Many leaders struggle to make the strategic choice about which opportunities to pursue, and which to put in the parking lot.

Get the Free Guide and Canvas to Create a SWOT Analysis

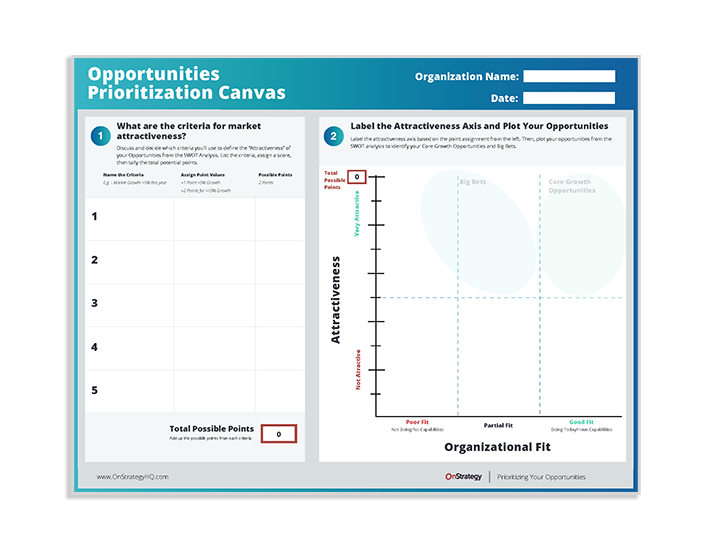

To help make this process easier, we’ve been using an awesome tool called the Fit/Attractiveness Matrix to help you sort, compare, and rate all of your opportunities.

What is the Fit/Attractiveness Matrix?

The Fit/Attractiveness Matrix is a tool to help prioritize and eliminate opportunities identified in your SWOT. It helps identify Core Growth Opportunities and Big Bets to create a prioritized list of opportunities to focus on.

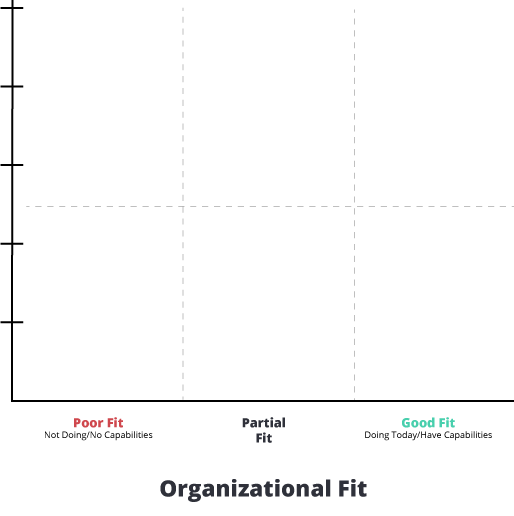

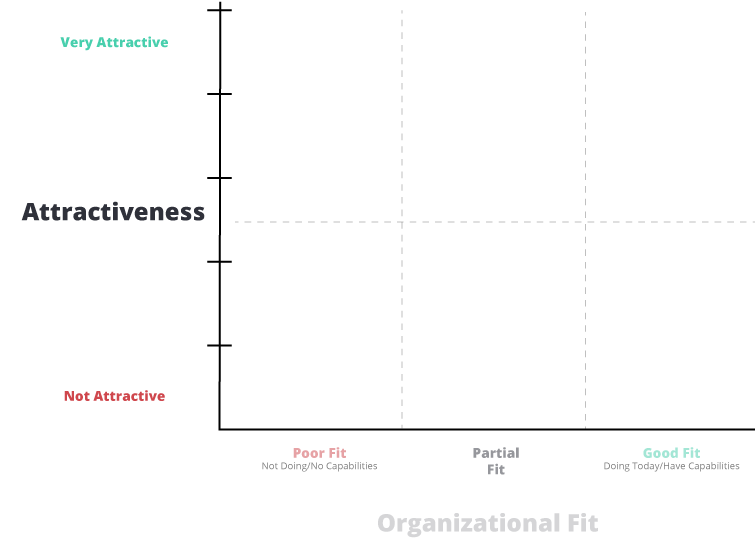

The Fit Axis

The X-axis is used to measure the “fit” of an opportunity: plot the fit of your organization’s opportunities against what you are or are not doing today, or what you are and are not capable of doing currently. A few considerations as you think about the opportunity fit:

- Is this opportunity something you can deliver on today?

- Is this opportunity something you already do today?

- Do you have the capabilities to act on this opportunity?

👍 Tip

As you plot your opportunities along the Fit axis, consider if your organization has the capabilities to act on those opportunities, i.e., if you don’t have the capabilities, you need to plot the opportunity in the “Not Doing/No Capabilities” quadrant. If with minor or manageable adjustments, your organization could create the capabilities/capacity, it’s a “partial fit.”

Get the Free Guide to Create a One Page Plan to Communicate Your Strategy

The Market Attractiveness Axis

The Y-axis measures the market attractiveness of your opportunities. You’ll work as a team to rate your opportunities from “not attractive” to “very attractive.”

Every organization has a different set of market attractiveness criteria to consider—some may want to identify just 2 or 3 key criteria, other organizations may need to consider 8, 10 or more. Do the good work to identify what will make a market attractive to your organization; knowing what makes a market attractive to your organization is essential before completing this exercise.

Here are a few criteria you might consider for market attractiveness:

- What is the total addressable market?

- What is the revenue / share potential for your organization in the market?

- Is there recurring revenue potential?

- Is the market growing or shrinking?

- How competitive is the market? Is there vulnerable or little competition?

- Where are you positioned? Will pursuing an opportunity improve your broader competitive position?

👍 Tip

We recommend giving opportunities a score based on the criteria you set. You’ll need to work as a team to determine how you’ll score these market opportunities. The higher the score, the higher the opportunity lands on the Y axis.

Using the Fit/ Attractiveness Matrix

Step 1: Decide How You’ll Evaluate Fit

Before plotting your opportunities, you’ll need to determine how you’ll define the “Fit” of each opportunity.

As a team identify:

- Poor Fit: Are these activities you’re not currently doing today? Are these activities you do not have the capabilities for? Or are these activities that would be too costly to deliver?

- Partial Fit: Do you have the capabilities, but it is an activity you do not currently execute or are there modest adjustments needed to make it a fit?

- Good Fit: Is this currently an activity or capability you possess, and one that you can deliver today?

Step 2: Decide How You’ll Score Attractiveness

Next, you’ll need to decide which criteria you’ll use to score the attractiveness of your opportunities.

This is up to the discretion of your planning team, but the simplest way is to pick a few criteria and award points if an opportunity meets each. Here’s how that might look in practice:

| Criteria |

Points |

|

Competition |

+1 for Low/No Competition |

|

Market Growth Potential |

+1 for Market Growth>5% this year |

|

Revenue Potential |

+1 for $X or Greater Per Year |

|

Recurring Revenue Potential |

+1 for Recurring Revenue Potential |

👍 Tip

Do one of these criteria have a bigger impact on market attractiveness? You can use a weighted scoring model to assign more points to more valuable criteria.

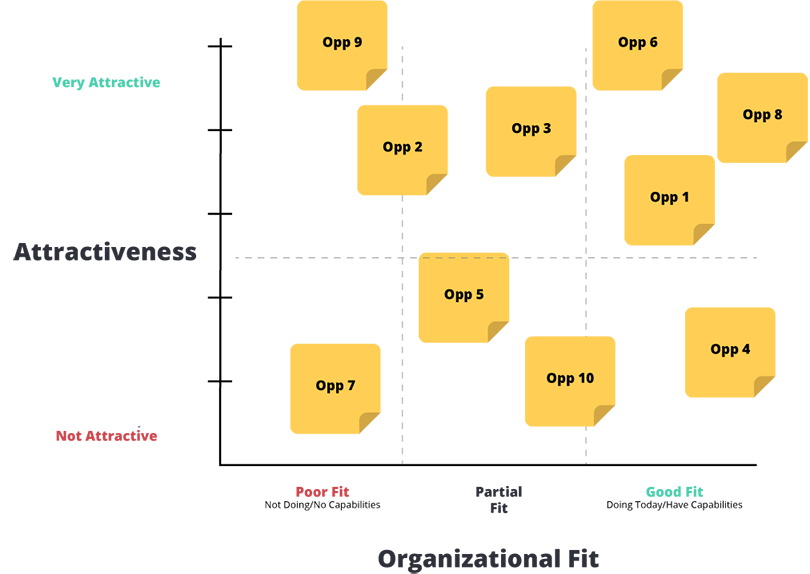

Step 3: Create Your Chart & Plot Opportunities

After you’ve defined the Fit and Attractiveness criteria, you can create your matrix.

You can use the canvas on the last page of this guide as a template to lay out this grid, draw it out on a whiteboard, or use a digital mural board (it’s free!).

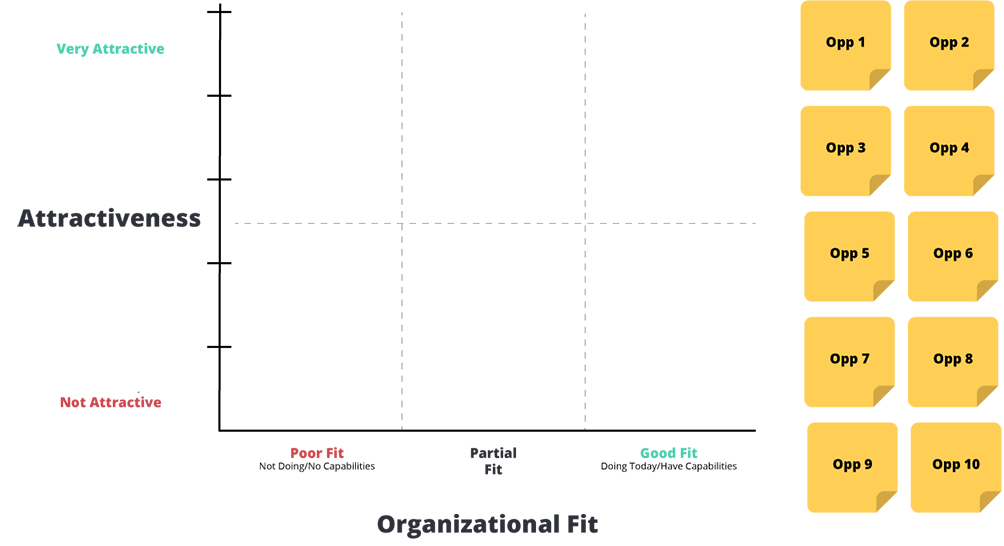

Once you’ve laid out your matrix and labeled the axes based on your own evaluation for fit and attractiveness, copy each opportunity from your SWOT onto individual sticky notes.

Step 4: Plot Opportunities

;

As a team, work through your opportunities to plot them against both the Fit and Attractiveness axes.

👍 Tip

Allow for 5-10 minutes of discussion before plotting each opportunity.

👍 Tip

Add notes about the market attractiveness to the stickie, e.g., the agreed-to potential revenue range.

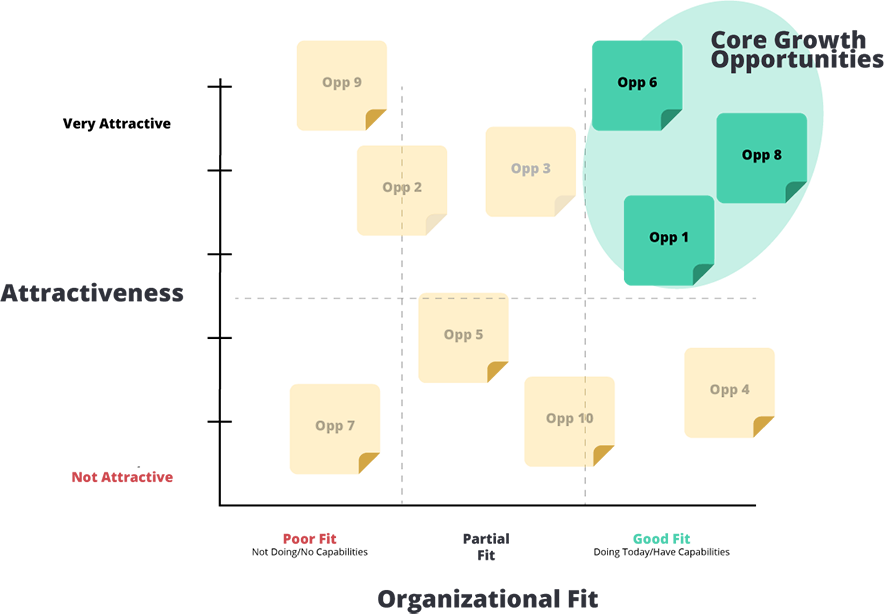

Step 5: Identify Your Core Growth Strategy

After you’ve plotted each opportunity within the matrix, your Core Growth Opportunities should be apparent.

Opportunities that are plotted as a good organizational fit (doing today/have the capabilities) and are attractive to your organization are considered Core Growth Opportunities. These are the least risky to pursue and have the highest probability of return.

👍 Tip

Core Growth Opportunities must have meaningful attractiveness! In this example, Core Growth Opportunities are those that meet more than half of the 8 market attractiveness criteria—set the ‘floor’ before you plot and don’t be tempted to move the floor lower after you’ve plotted opportunities.

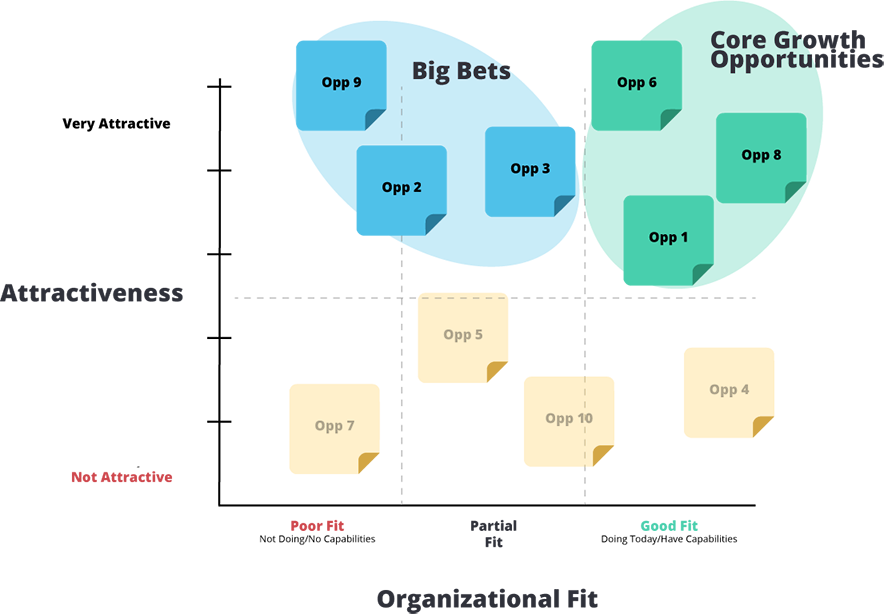

Step 6: Identify Big Bets

Once your Core Growth Opportunities have been identified, move on to identify your Big Bets.

These are the strategic moves that might be a little farther away from what you’re doing today, but still represent an attractive market opportunity you shouldn’t ignore.

We recommend prioritizing these opportunities after your Core Growth Opportunities, working sequentially from right to left. In this example, you would prioritize opportunity three, opportunity two, and opportunity nine in that order.

👍 Tip

You can move a Big Bet to a Core Growth Opportunity through an acquisition. You must have capability to act on an opportunity for it to be a Core Growth Opportunity.

Step 7: File Other Opportunities for Later

Any opportunity that does not score well on fit or attractiveness should be filed away for another time. These opportunities might steal focus from what is most important to realize growth in your organization.

👍 Tip

Remember, this exercise is about prioritizing opportunities! It’s okay to eliminate opportunities that aren’t likely to yield the results you need to realize.

That’s it! You’re on to developing your plan!

At the completion of this exercise, you’ll have a list of prioritized opportunities that you can use as you develop your strategic plan and growth strategy!